There isn't a huge amount to separate Xe Money Transfer from its competitors, as far as its general offering goes.

Fees are pretty competitive but not a slam-dunk cheapest option every time.

Transfer speeds are generally what you'd expect, impacted by payment method, transfer size and currency destination.

Their mobile app is just fine, and their customer service is actually rated pretty highly compared to other digital rivals.

So for me, Xe is a solid, dependable provider that comfortably sits in the middle of a crowded market.

Who should choose Xe Money Transfer for their international payments?

I would say Xe could be for you, if:

You searched live rates and found they offered a competitive quote for your specific needs

Fees & exchange rates

Xe Money Transfer fees come in the usual format:

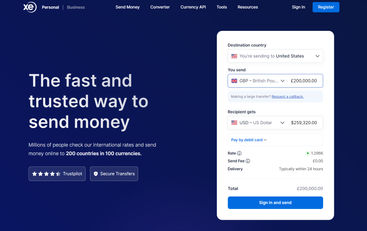

Exchange rate mark-up: while a few companies offer direct access to mid-market rates, most - including Xe - give you a slightly worse rate that has been marked up. This increases the cost of your transfer.

Transfer fee: many transfers with Xe will be free from transfer fees, but keep an eye out for them. They become more of a factor for small transfers.

Intermediary bank fees: these fees are not charged by Xe, nor any other money transfer company. They're actually charged by slightly random third-party banks that might be needed to get your money to its destination. This means they're impossible to predict. While they're usually only about £20 or so, they can come as a surprise if you aren't expecting them.

In my analysis across a few dozen sample searches, Xe's overall costs were quite typical. I didn't find them to be the cheapest transfer option for any particular search, but they were often within touching distance.

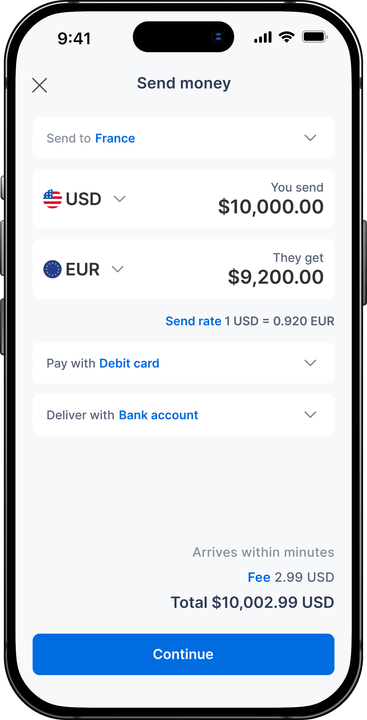

Mobile app

Xe is best known for its currency conversion tools, used by millions before they ever offered money transfers themselves.

The same app that provides these handy currency functions will also let you send money and track progress of your transfers.

I really like the fact that the app has value beyond just sending money. For on-the-fly currency conversions or to keep on top of the latest rates, you'll find yourself using the Xe app more often than some of the competition.

Naturally the app does try to push you towards sending money, but given that you're reading this review, I assume you're up for that. So it's nice to get access to a more impressive set of currency tools than most competing apps offer.

Speed of transfer

The main things that prevent you from enjoying a fast international transfer are common across various providers.

That being said, Xe does provide some specific guidances on transfer speeds for their customers.

Xe provides an Activity screen that shows the status of pending transfers. You can also interact with their virtual assistant, Lexi, but let's be honest - they're usually more annoying than helpful.

As you'd expect, routine screening by all regulated money transfer companies could slow down your transfer. Here the key is to resolve things quickly. If this does occur, you'll see an 'Action required' status appear.

This usually requires the submission of documents or explanation of the purpose of transfer.

Xe also encourages users who are focused on speed to fund their transfer by card payment. Xe receives card payments almost instantly, which lets them get on with sending your funds onward to the recipient.

Bank transfer and direct debit payments could take up to 3 business days to be received by Xe.

After this, Xe says to expect delivery timescales of 1 to 4 business days. For more common currencies and countries, this seems a bit conserative - many customers do see funds arrive same day.

The fastest transfer is always an early transfer, so if you can get ahead of the game, you'll have more flexibility on payment method.

Business services

With a heritage in building currency tools and FX connectivity, it's no surprise that Xe excels at platforming other businesses.

This could be from straightforward one-off or regular business transfers abroad, all the way through to more complex integrations and API wizardry.

Entrepreneurs: if you're a freelancer or small startup, Xe can simplify your FX situation while cutting costs, and stay out of your way throughout.

Scale-ups: for a growing organisation, FX risk management starts to become more critical. Xe has tools and experience to help here.

Enterprise: Xe offers custom solutions for complex global organisations, if that's what you're after.

I imagine that most of you will be in the first category, maybe the second.

In that case, the simple way to think of it is this: easy international payments are open to businesses, as well as private clients.

Beyond this, you can benefit from forward contracts to lock in future rates, plus market orders, option contracts and more.

Safety

Xe Money Transfer is a trading name for a UK company called HiFX Europe Limited. HiFX was an FX service that was acquired by Xe's parent company.

HiFX Europe Limited is authorised by the Financial Conduct Authority, which should give payers in the UK peace of mind.

Within the Xe Group are other entities, which themselves have licences in juresdictions including the EU, Australia, New Zealand, Canada and the US.

All these companies are part of a larger company called Euronet Worldwide, Inc. which trades on the NASDAQ stock market.

In all, Xe Money Transfer is a highly regulated business which is able to offer its service to UK customers.

Customer service & reviews

Xe has strong review scores on TrustPilot, with an average of 4.3 out of 5, and 80% of reviews being 5 star.

The main complaints from users tend to be about account closures during a pending transfer. This is definitely a frustrating situation, and it's made worse by the fact that Xe usually won't be able to give you a reason.

It all comes back to the fact that these firms are subject to financial regulations. This is to help combat scammers and fraudsters. These scammers can adapt their strategy if they understand why their account was flagged.

So even though you're not doing anything wrong, if the systems flag your account, you could be shut down with no explanation. I'll create a guide with more informaton on account closures very soon, as this isn't a problem unique to Xe.

Xe Money Transfer contact details

Official website | |

|---|---|

Phone number (UK) | +44 1753 441 844 |

Office opening hours | Monday to Friday, 24 hours |

Live chat | Available to logged in users |

Business address | 1145 Nicholson Road, Suite 200, Newmarket, Ontario, Canada |

Social |

More reviews