From one-off payments to managing a multi-currency life; Wise ticks our boxes

Wise has led the digital revolution in international money transfers.

Their multi-currency accounts enable sending, receiving, converting and even earning interest on your funds.

Read on to find out what makes Wise so innovative, and why some might prefer a more traditional broker service.

Wise vs. banks for international transfers

Wise easily beats high-street banks for sending money abroad. That's right - forget NatWest or Halifax. Specialist money transfer companies are the way forward.

Comparison point | Wise | Typical bank |

|---|---|---|

Fees | ✅ From 0.33% | ❌ £10-20 |

Exchange rates | ✅ Mid-market rate | ❌ 2-4% |

Transfer speed | ✅ Typically 0-2 working days | ❌ 2-5 working days |

Customer service | ✅ Good | ❌ Average, non-specialised |

Why customers use Wise

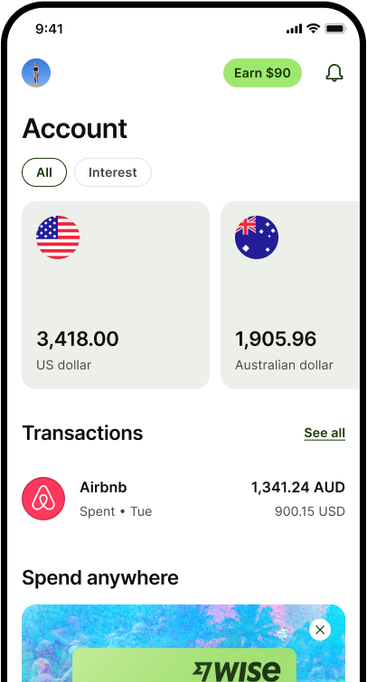

Wise is known for having a fantastic website & app, making it clear and easy to send money with them.

As well as being great for one-off transfers, it's also possible to manage more of your currency life with Wise.

Customers even use their Wise card as a daily spending tool. So Wise can really become a part of your financial life, if you're up for that.

Regular transfers abroad - The excellent app design and website makes Wise perfect for regular use and frequent payments, small or large. For example, it's common for expat or remittance payments to be sent using payment apps like Wise.

Large transfers - Wise can be used for transfers above £10,000, £100,000 or even more. Wise has a limit of £1million per transfer of GBP. So if you're moving abroad, buying or selling properties, retiring or making a large purchase, Wise is on hand.

Tip: prefer to make a large transfer with a dedicated account manager to support you? A currency broker might be a better fit.

Receiving money - Wise lets its customers receive and hold money in many currencies. It's easy to lose out when receiving international transfers, so this could be very handy.

Business - Wise has a dedicated business product. This offers access to things like account software integration and expense management.

Cost structure - fees & exchange rates

My verdict on Wise pricing

The combination of zero FX markup + low variable fees does often result in competitive costs.

This no-nonsense pricing will appeal to many.

Being a digital service, Wise makes everything clear up-front, so you can quickly find out if they are competitive for your specific transfer.

Features

Multi-currency account - Wise offers local accounts in 10 currencies, plus the ability to hold 48 currencies and send 73. That's the most impressive currency roster I've seen on a personal multi-currency account.

No markup on mid-market rate - You can relax with Wise, knowing that they'll be giving you the best rate on the market. They aren't doing it for charity, though. Wise does charge fees, which are transparent and quoted separately. This makes it easy to know how much the transfer is truly costing you.

Wise Interest - you can earn a variable rate return on your GBP balances with Wise. It's important to be aware, though, that this yield is not guaranteed, and your capital can be at risk if you enroll into the programme.

Business payments

Incoming and outgoing business payments can be handled with Wise.

It's easy for global business of any size to suffer from FX losses. A Wise Business account is designed to get currency moving through your business with maximum efficiency.

We have a Wise Business review in the works, which will go into greater detail on their offering for freelancers, SMEs and corporates.

Wise versus its competitors

Receiving money

Wise is a good pick for those expecting incoming international transfers.

As Wise offers multi-currency account capabilities, you can receive funds to a Wise account and convert them to your chosen currency for a modest fee.

I put together a guide on how to receive money from abroad, which is worth a look. In it, one of my recommendations is to open a multi-currency account with a company like Wise.

In reality, there is nobody on the market right now who can really claim to beat Wise in this area. Well, maybe Zing - but probably just for small transfers.

Limits

Wise has recently added a high-value transfer team, able to cater to high limit payments. They claim to be able to handle international payments of up to £2m.

I'm glad they're bringing more of a personal touch to these large transfers.

Even though Wise is considered a trustworthy company with an excellent self-serve app and website, there's nothing like picking up the phone if you're sending six figures or more.

Transfer speed

It's always tough to be too specific about transfer speeds - especially when talking generally.

Wise do as good a job as any, with the way they give real-time transfer estimates as you set your payment up.

Check Wise speeds with our search tool

Our currency exchange tool takes fresh data direct from Wise, revealing an accurate idea of costs and timelines.

One of the common complaints you might hear about Wise relates to their KYC and account restrictions.

That's why, if fast transfers are important to you, it's important to get ahead with your documentation and verification. This will cut the chance of any delays.

Safety

Wise is an electronic money institution, not a bank. This means they do not offer FSCS protection up to £85,000 like UK banks do.

However, as part of their licence agreement, Wise is required to hold customer funds in segregated accounts.

This means should Wise end up in financial trouble, your funds should not be lost. You may, however, have to wait a while for everything to be unpicked and distributed.

Thankfully, Wise is generally considered a well capitalised and stable business, trading on public markets and with millions of customers.

So while it may be a modern fintech, it's actually been around a while and has all the safeguards you'd expect in from a service like this.

Customer service

Wise takes a modern approach to customer service. That is, they try to have you figure out the answer to your own question through their FAQs.

Then, if you have an account, you'll have to log in to actually contact support.

Once logged in, you can request a callback, send an email (they aim to respond within 1 day), or use live chat (but for me it was unavailable at lunch time on a Monday).

We understand why they do this. Part of offering lower fees involves using technology over people to keep costs down.

This might put some people off, though. Contrast this to TorFX, which puts its phone number at the top of it's home page. Wise's product and app is a level above that of TorFX, though!

So part of the decision between app/online vs broker, is: what do you value more?

The self-service features of Wise vs. the easy, responsive access to UK customer service offered by FX brokers?

Wise contact details

Official website | |

|---|---|

Phone number | Not available without an account |

Business address | 6th Floor, Tea Building, 56 Shoreditch High Street, London, England, E1 6JJ |

Social |

More reviews