TorFX is a fantastic choice for sending money abroad.

As a currency exchange specialist, TorFX offers competitive exchange rates without additional fees.

Their service is also top class, with 24/7 support and friendly account managers to help you with your transaction.

Read on to find out where they excel, including who I think TorFX is (and isn't) suited to.

TorFX vs. banks for international transfers

As a currency specialist, TorFX has a big advantage over traditional international bank transfers (for example, sending to a foreign bank account directly from Lloyds Bank or Barclays).

Comparison point | TorFX | Typical bank |

|---|---|---|

Fees | ✅ £0 | ❌ £10-20 |

Exchange rates | ✅ 0.2%-1% | ❌ 2-4% |

Transfer speed | ✅ 0-2 working days | ❌ 2-5 working days |

Customer service | ✅ Excellent, specialising in currency transfers & advice | ❌ Average, non-specialised |

Why customers use TorFX

TorFX excels at offering a highly personal service, with account managers to guide you through your transactions.

They back this up with fee-free transfers and competitive exchange rates.

This makes TorFX ideal for customers making important, high value transactions. For example:

buying or selling a property abroad

emigrating

transferring wealth between currencies

business transactions

& many more

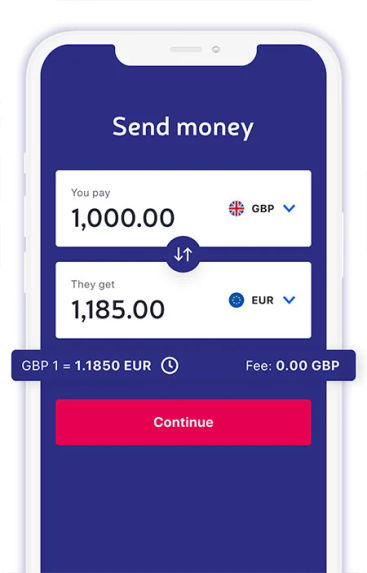

If you prefer more of a tech-focused approach, you might prefer companies like Wise or Xe. For lower value transfers, these options are usually superior to currency brokers like TorFX.

Cost structure - fees & exchange rates

TorFX pricing is simple, but not entirely transparent.

As we know, international payment costs come from fees and exchange rate mark-up.

TorFX fees are simple to understand: there aren't any. No fees.

How about their exchange rates then? Are they competitive, or hiding large hidden fees?

Well, their FX margin percentage tables are not publicly disclosed.

It's also possible to negotiate a better rate over the phone.

This means we can't give definitive detail on how good their exchange rates are.

My verdict on TorFX pricing

From what I've seen myself, as well as heard from other customers, TorFX exchange rates are very good - certainly far better than using a bank.

And when fees are factored in, their pricing is comparable to the best on the market.

If high-touch service and FX advice is important to you, then I say TorFX could feel like a really good deal.

Features

TorFX offers a range of important currency-specialist features that set it apart from banks and other international payment apps.

✅ Forward contracts

Planning to make an international payment in the future? You can fix an exchange rate with TorFX up to two years in advance.

This gives you certainty and shelters you from fluctuating currency values.

International weddings, property abroad and other large purchases often take time to complete. Forward contracts can remove the guesswork and make budgeting more accurate.

✅ Market orders

TorFX offers advanced currency trading features, including:

Limit orders: set an exchange rate target above the currency level. If the market hits this level, TorFX will automatically process your transfer.

Stop loss orders: set a worst-case exchange rate. If rates fall to this level, your transfer will be processed, protecting you against rates worsening further.

✅ Recurring payments

Set up a recurring payment of between £500 and £10,000 per month. TorFX will execute the transfer automatically at a low cost.

✅ 24/7 transfers

TorFX phone service is not available 24/7, but with their mobile app, you can make currency transfers all night long.

Business payments

TorFX actively caters to business customers.

However, it's worth noting that the products and services offered are essentially the same for business and personal.

Still, the firm is able to extend its core benefits of 24/7 transfers, zero fees, competitive rates & expert support to finance teams & management of small to medium sized businesses.

Your business account manager will guide you on risk management strategies and help you minimise foreign currency losses.

TorFX highlights import/export, foreign payroll & overseas earnings as key areas where their expertise can benefit businesses.

Receiving money

TorFX is designed for sending money.

They do not offer currency accounts to which money can be sent. This means they don't directly support people looking to receive and manage multiple currencies.

If you are going to be the recipient of an international money transfer, I suggest reading our guide to receiving money from abroad.

Although if you are able to work closely with the sender, you could certainly recommend that they use TorFX. This would allow you to receive money efficiently to your local bank account.

Limits

TorFX is very well suited to handling large transfers. They claim no maximum transfer limit - and say they can help with transfers from £100 to £10m. That's a pretty wide range!

Transfer speed

It's always difficult to talk about speed in general terms. As we know, it varies hugely by the individual's circumstances - the send amount, the currency pair, the source and destination countries, and even the time/day of week.

TorFX states that funds should arrive on the same day, or within no more than two working days for exotic destinations or currencies.

Another benefit of TorFX customer service, is you can easily contact the team to check on the status of a pending transfer. Especially helpful if you have an urgent payment to make.

Safety

TorFX is responsible for operating segregated client accounts.

TorFX is authorised by the Financial Conduct Authority as an Electronic Money Institution under the Electronic Money Regulations 2011.

Their FCA Firm Reference Number is 900706. Learn more abour TorFX's regulatory status in the UK on the FCA website.

TorFX also holds a Level 1 rating (minimum risk) from leading credit rating agency, Dun and Bradstreet.

Funds sent with TorFX are not covered by the Financial Services Compensation Scheme. This is normal with regulated electronic money institutions. The use of segregated accounts should allow funds to be returned by the liquidator in event of administration, although this could take some time.

The company has been in business over 20 years, and I would say it offers strong safety & security credentials based on the above.

Customer service

As a currency broker, customer service is an important strength for TorFX.

You'll find their phone numbers prominently listed on their website - they don't shy away from speaking to customers (new or existing).

After submitting a request for a free quote, you'll likely receive a number of callbacks. In my experience, you could get quite a few calls, but when you speak to an operator, there is no hard sell.

TorFX is currently rated 4.9/5 on TrustPilot, which is an exceptionally high score. In my view, this reflects largely on their customer service. Any issues can be easily understood and smoothed out by emailing or calling their UK-based team.

TorFX contact details

Official website | |

|---|---|

Phone number (UK) | 0800 612 9625 |

Phone number (international) | +44 (0) 1736 335 250 |

Office opening hours | Monday - Thursday, 8:00am - 7:00pm Friday, 8:00am - 5:00pm Saturday, 9:00am - 1:00pm |

Business address | TorFX, Pz360, St Mary's Terrace, Penzance, Cornwall TR18 4DZ |

Social |

More reviews