Zing is shutting down

HSBC announced that Zing is to be closed, one year after launching in the UK.

Zing will work as normal until 2nd April, and will fully close down on 22nd May.

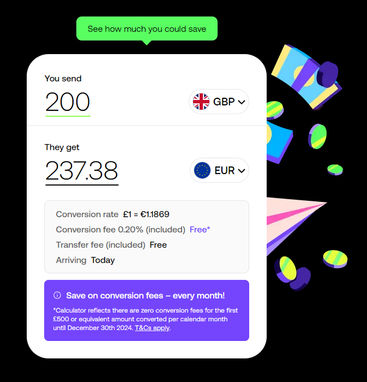

You can expect currency conversions at a low total cost of 0.2%, with £500 worth of totally free conversions per month, now extended until the end of April 2025. That's impressive.

Is it a done deal then? Should you be signing up with Zing immediately? I wouldn't be so sure, as for some customers, Zing isn't the ideal pick.

Who is Zing right for?

Many people haven't heard of Zing yet, but the app is getting more popular by the day.

If you match any of the following use cases, you might find Zing valuable.

Regular monthly currency transfers - Zing's generous offer of free conversions up to £500 per month, and then 0.2% above that, makes Zing the cheapest option in the UK market for smaller, regular monthly transfers.

Travel money card for spending abroad - Zing offers physical and virtual cards to let you spend abroad like a local. I've personally used this card across Europe with great success. Apple Pay integration is very smooth, and the fees were miniscule.

Which situations call for an alternative?

Large transfers - Zing currently has relatively low limits. For higher limits, consider a provider like Wise, or a currency broker

Mission-critical transfers - While Zing has made a strong start in the UK market, I wouldn't feel confident using it to send urgent or critical transfers yet. Customer service with digital services like this can be slightly lacking. For that extra reassurance, I suggest using a provider that has proven customer service to support you throughout.

Business payments - right now ZIng is focused on personal customers.

Zing vs Wise vs traditional banks

Comparison point | Zing | Wise | Typical bank |

|---|---|---|---|

Fees | ✅From 0.2% (currently 0% for £500 per month) | From 0.33% | ❌ £10-20 |

Exchange rates | ✅ Mid-market rate | ✅ Mid-market rate | ❌ 2-4% |

Transfer speed | ✅ Typically 0-2 working days | ✅ Typically 0-2 working days | ❌ 2-5 working days |

Customer service | Good, but some teething problems | ✅ Good | ❌ Average, non-specialised |

Transfer limits | ❌ £40k | ✅ Up to £2m | Usually £25k per day online, £100k by phone |

Official site |

Safety

Zing is a regulated electronic money institution. While this means they don't offer FSCS protection up to £85k, they are required to hold customer funds in segregated accounts.

Zing is part of the HSBC Group, but is separate from HSBC UK Bank plc. You can be assured this isn't a fly-by-night operation. Everything will be handled properly and to the highest standards, in line with their licence requirements.

The HSBC backing certainly provides that added bit of comfort. Zing is also looking to build a strong reputation as a new brand, so I wouldn't expect any complacency here.

Customer service

Zing handles support via in-app messaging and email. Their contact page states that they don't provide a contact telephone, however you can request a phone call through the messaging routes.

My experience with the in-app messaging as a little mixed. The in-app messaging starts off as a chat bot, which many of us find frustrating nowadays. Thankfully, when I told it that cookie-cutter messages hadn't solved by query, I was connected to a real human.

There was then a long wait to get responses to messages - it wasn't a live chat, more like slow emails inside an app.

When I tried to continue the conversion after some delay, the chatbot came back to life, and I had to tell it to go away (messaging 'chat to team' seemed to do the trick)

Overall, I got the answers and result I needed, just a bit more slowly and painfully than I'd have liked.

I expect Zing's customer service to continually improve - but for those with high customer service standards, a cheap-as-chips transfer app like Zing isn't really the product for you.

More reviews