Unfortunately, it can be all-too common. UK-based firms sending or receiving money abroad could be losing 3% or more by letting banks handle their international transactions.

With the increasingly global spread of workforces and customers, borderless business is on the radar for many.

Common scenarios where a tailored FX solution could help your business include:

Understanding your current FX exposure, risk & opportunities

Receiving income from international customers

Paying bills to overseas suppliers

Making regular salary payments to a global, remote workforce

Handling batch payments with ease, without having to sacrifice on currency performance

Private customer?

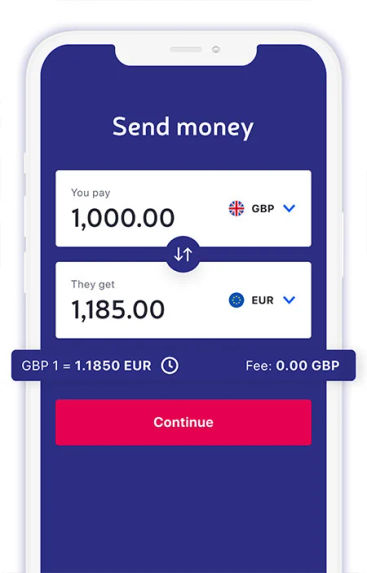

To send money personally as an individual, you'll want to review my list of top currency transfer companies.

Reviews of business FX solutions

Let's look more closely at some of my top picks for businesses. I've grouped them into companies best for the odd transfer, and those more suited to a deeper platform offering.

For one-off or occasional payments (as a freelancer or business)

Wise is becoming an increasingly powerful tool for businesses of all sizes.

The company has been used by digital nomads and global freelancers since pretty much its inception.

Over time the offering has matured, and now also caters to larger firms, as well as providing platform solutions to banks and other fintechs.

Wise currently holds more than 60 licenses worldwide, backed by over 90 banking partnerships. These guys are no joke.

Wise Business lets you send money via local transfers and cross-border wires to 160+ countries and 50+ currencies.

Receive payments in 40+ currencies and benefit from local account details in 10 countries and counting.

Get physical and virtual cards for you and your team, issued in multiple countries.

Nail your treasury game by holding funds in 40+ currencies with mid-market rate conversions

Integrations include Zero, QuickBooks and FreeAgent, helping Wise embed itself in your existing finance operations.

You can also benefit from 1,000-strong batch payments, team access controls, interest-earning accounts and no subsciption costs.

For me, it's a no-brainer to open a Wise Business account and have a play around. It could quickly become your go-to for your international money affairs.

TorFX is perfect for small to medium sized businesses who value personal relationship management.

While TorFX doesn't have quite the same fintech credentials as Wise, it does make for a very viable FX partner for business across Britain.

The firm's dedicated business unit is on hand to help you maximise the potential of your business from an international payments perspective.

They're also ideally positioned to help you build an FX risk strategy to thrive out there in the market.

TorFX offer various trading contracts beyond the basic, including limit and stop loss orders, as well as forward contracts.

You'll be able to transfer up to £100,000 online 24/7, or contact your account manager to faciliate global payments with no limits.

In terms of transfer pricing, TorFX takes the opposite approach to Wise - they charge no fees, but do mark up their exchange rates to turn a profit.

I can't help but think a conversation with TorFX is always worthwhile for any business wanting to understand how they can turn FX exposure to their advantage.

Embedded borderless payment integrations (to streamline & save)

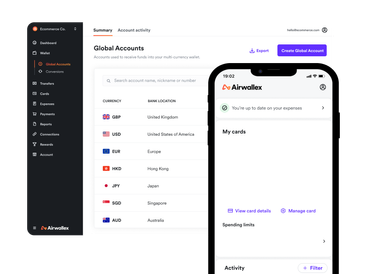

Airwallex does more than just help you send money abroad as a business.

It's aim is to become your embedded financial platform, and to handle all your FX needs in the process.

Airwallex is a developer-friendly system, offering APIs and detailed documentation to help you integrate their platform into your own systems and processes. Airwallex APIs handle over 50m requests per day, and the firm actively angles itself towards tech-focused companies.

Airwallex does also offer a more typical business acount for freelancers, SMEs and larger firms. Features include:

Global business acounts

Business FX transfers at competitive rates

Borderless cards

Expense management

Bill pay

Integrations with Xero, Quickbooks, Shopify, WooCommerce, eBay, Amazon and many more

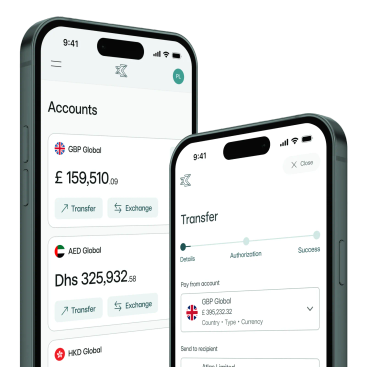

3S Money launched in 2018, aiming to change the financial landscape for entrepreneurs.

The London-based team has thrived since, now with 7 global offices and licences including FCA (UK), CSSF (Luxembourg) and DFSA (Dubai, DIFC).

They're all about helping you do business without borders.

You can get access to a multi-currency account supporting 65+ currencies and 190+ countries.

3S offers dedicated relationship management (no chat bots) and supports non-residents.

Local IBANs in UK, Luxembourg and Netherlands

Batch payments

Team access controls

3S Money's pricing model is based o a monthly subscription fee, beginning at $25/month for the Starter plan.

You can upgrade to Standard or Enterprise plans, costing $100 and $300 per month respectively. For this, you'll get up to 53% off your transaction fees vs. the base plan, with more user seats and a personal relationship manager.

3S Money also offers a bespoke 'Enterprise Plus' tier, featuring API integrations, plus even cheaper transactions and more user access.

Full list of companies that provide FX services to UK businesses

Provider | Service summary |

|---|---|

Wise Business | International money transfers & currency accounts for freelancers & businesses |

Wise Platform | Integrated solutions for corporations, banks and companies seeking deep integration |

TorFX | Currency broker catering to business clients |

Currencies Direct | Currency broker catering to business clients |

Revolut Business | Fintech service with business-centric product arm |

Airwallex | International payments platform for businesses |

Payoneer | Global money management for freelancers, businesses and marketplaces |

IFX Payments | Broker-turned-business FX platform (ibanq) |

3S Money | Business foreign exchange SaaS service, catering from entry level to enterprise |

Rapyd | Global payment processing for accepting payments, sending payouts and issuing cards |

Sokin | Supports multi-currency businesses with local USD, GBP and EUR accounts + over 75 accepted currencies |

OFX | Large plc FX broker backed by Paytron B2B software platform |

Multipass | Borderless business account with virtual IBAN, payment card & tailor-made solutions |

Equals Money | Finance platform that includes multi-currency accounts, international transfers & enterprise integrations |

Caxton | British-owned fintech platform offering a suite of FX services for companies large and small |

Moneycorp | Foreign exchange solutions for corporates, financial institutions and private clients |