Overall, the best money transfer companies in the UK include Wise, TorFX and Xe. Also consider Cambridge Currencies, an up-and-comer in the UK market.

Wise offers mid-market exchange rates and transparent fees, while TorFX focuses on top-class UK-based customer service. Xe provides an excellent option for those seeking the best deal.

Traditional banks lick their lips at the prospect of large currency transfers, profiting thanks to their uncompetitive exchange rates.

That means that you'll end up with less money once the transfer is over. In some cases, up to 3% or even more.

But what is the alternative?

I've got plenty of good options, but first I need to understand what's most important to you.

Summary: who's the best?

I always recommend comparing live rates - this is the only way to know who is best for your specific needs, like send amount, countries, currencies & other requirements.

If you still need a quick answer, then I actually have two answers for you.

If you want a great app backed by competitive, transparent pricing, choose Wise.

If you value personal customer service, support and foreign exchange advice from professionals, go for TorFX.

Can't decide between them? Read my Wise vs TorFX comparison.

Scroll on for more details and more options, and you'll be ready to make an informed decision.

"Cambridge Currencies is a boutique UK-based currency broker helping clients send funds globally. Expect personable service & competitive rates from this new industry entrant."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

Deep-dive money transfer company reviews

My four best money transfer companies supporting UK clients

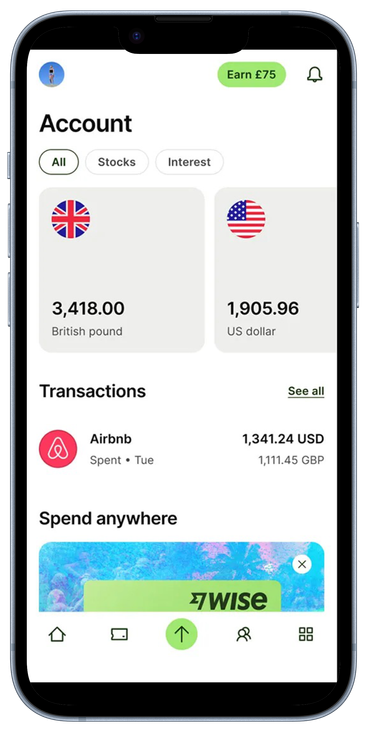

Wise, formerly known as TransferWise, is one of the UK's leading digital money transfer companies.

I've rated them as top pick, as I think most people want to get an idea of transfer costs without having to speak to someone on the phone.

(If phone is your preferred approach, though, check out my review of the best UK currency brokers)

You can easily get an accurate figure by visiting Wise's website and inputting your countries, currencies and amount.

Wise exchange rates are pegged to the mid-market, which is the best you're going to get. Fees are also reasonable, though do vary per transfer.

To make comparison easier, insert the same details into our rate search tool and see how they stack up against the rest.

Wise have mastered the art of mobile money transfers. You can be ready to send money very quickly, pending verification, with just a few clicks.

The downsides? Customer service isn't as attentive as you might find with a broker. Some of the advanced currency features to manage risk are also lacking.

But if you want to quickly and quietly get a transfer sorted, with low cost and low difficulty, there are none better at the moment.

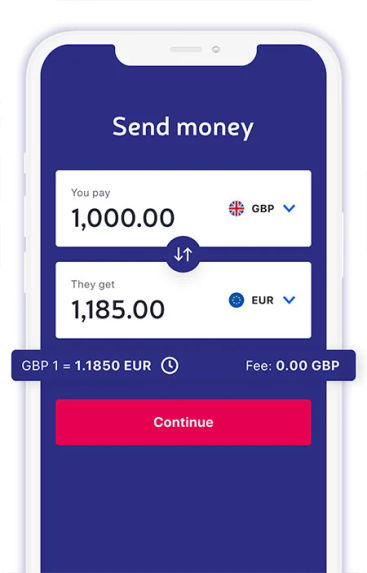

TorFX, headquartered in Cornwall, UK, is one of the country's most experienced FX specialists.

The firm works with individuals and businesses to faciliate mid to high value transfers. Their minimum is usually around £2,000.

TorFX connects is customers to a team of account managers who can support through the entire transfer process.

They've handled pretty much ever transfer scenario you could imagine.

Their first-hand experience ranges from international property purchases to emigration, retirement, studying abroad and everything in between.

TorFX charges no fees, but does apply markup to its exchange rates. Exactly how much varies for each transfer, so you'll need to request a quote to see if they're competitive for you.

There is no limit on the amount you can transfer with TorFX - they're very comfortable handling ultra-large transactions.

A UK-call centre with FX specialists on hand is always a nice feeling when you're moving substantial amounts of cash.

Regency FX is a relatively new foreign exchange broker based in the UK.

The team has great credentials, having worked at some of the country's largest and most successful FX brokers.

They've now started their own brokerage and are building a strong reputation.

We like the combination of a small size, with big experience behind them. You can expect high-touch customer service, with Regency FX going the extra mile to build their brand and a loyal customer base.

You can expect all the usual FX broker features, including spot contracts, limit orders, forward contracts and regular payments.

Their platform is enabled by Equals Connect and Currency Cloud, both UK-licensed liquidity providers.

Transfers incur zero fees - instead, you can expect a percentage markup to be applied to the exchange rate offered. This means you won't be getting the mid-market rate.

To find out whether Regency FX can offer a competitive price for your needs, you can request a free quote.

Xe Money Transfer has been in the business for 30 years - you've probably stumbled across them when looking for exchange rates online.

As well as checking rates, they offer a transfer service that is very popular.

Xe generally charges no fees, but does quote worse-than-mid-market rates, so you'll need to keep an eye on that when comparing.

Their app is simple yet effective, and customer reviews are consistently high on sites like TrustPilot.

Xe's online transfer limit for a single transfer is £350,000, which covers most use cases. You can always send in multiple transactions if you need a higher limit.

Recipients can have funds arrive at their bank account, to a mobile wallet, or for cash pickup (depending on their location).

Sending as a business?

Most of the companies on this page also cater to corporate clients as well as individuals. From freelancers to FTSE 100 firms.

But for more specific detail on business features & functionality, as well as B2B-specialist providers, see my tips on international money transfers for businesses.

Benefits offered by money transfer specialists

Let's understand what people tend to look for in a currency specialist.

Value for money

This is the big one. For many, a better international transfer is a cheaper one. And for pretty much all internatonal payments, cost is a substantial factor.

Keep in mind that cheaper transfers can sometimes be slower, and sacrifice more personal customer support.

If low costs are your main priority, skip down to our summary of the cheapest providers or check out our dedicated guide to the cheapest ways to send money abroad.

Speed

Sometimes you urgently need to get money to its destination overseas.

When speed is what matters most, you might need to pay a little more for an expedited transfer.

Read on for more on rapid transfers (including instant or near-instant). You can also delve deeper into transfer speeds with our fastest international payments guide.

Support

Do you value 24/7 phone support, and a dedicated account manager assigned to your file?

Currency brokers can provide invaluable advice on your currency moves, as well as reassurance and that human touch.

Scroll to view our favourite FX broker picks. The full list of recommended currency brokers should also be essential reading - especially for those making large transfers.

Ease of use

Let's face it, not many of us are converting currencies for fun.

We're trying to get something done, achieve a goal or move forward financially. Some money transfer companies excel at making that easy.

Removing that friction, while working hard in the background to make everything feel easy.

I'll round off this guide with a few of the easiest to use money transfer services available to UK customers.

Cheapest money transfer companies

Without sounding like a broken record, do a quick rate search to find out who is cheapest for you.

With that out of the way, let's take a look at some of the top companies and their typical fee structures:

Money transfer company | Fee | Exchange rate markup |

|---|---|---|

Starting at 0.35% | No markup | |

No fee | Typically around 1% | |

No fee | Typically around 1% | |

Zing (closing May 2025) | £0-500/month - No fee £500+/month - 0.2% | No markup |

No fee | Typically around 0.5% | |

No fee | Typically around 1% | |

No fee | Typically from 1.3% | |

£1.99 for small transfers No fees for medium to large | Typically from 1.5% | |

No fee | Typically from 1.5% |

I put together a separate guide on finding the cheapest international money transfer options, so if price is key for you, please do have a read.

Fastest ways to send abroad

Transfer speeds are more difficult to cover in general teams than costs. Here I'll give you some general indications, but if speed is important, please don't rely on these estimates alone.

I'm pretty confident that the companies listed below have some of the fastest transfer speeds, so if you have a deadline, please set up a transfer with each and compare speed estimates.

Money transfer company | Transfer speed estimate |

|---|---|

Many transfers arrive same or next day Very large transfers can take a day or two more | |

Often same day, usually within two working days Can be more for exotic destinations |

For more detail on the ins and outs of international payment speeds, take a look at our deep dive.

Best for support & service

The main USP of any currency broker is its customer support.

That's why if you're looking for immaculate account management and responsive phone support, you should focus on this category of money transfer company.

It's clear from TrustPilot ratings that brokers leave customers more satisfied than self-service alternatives.

It's probably not because they have fewer issues - it's always possible for something unexpected to happen with a transfer.

No, the difference is that broker customer service is extremely good at solving these issues, either before they arise, or shortly after.

The result is happy customers, who feel heard and understood.

We have a dedicated guide to currency brokers, but if you want to know my top recommendations for those with 5* support, they are:

TorFX - exceptionally experienced in all things FX, TorFX are just a phone call or email away. Expect first class service backed by vast FX and international money experience.

Regency FX - cut from a similar cloth to TorFX, Regency offers fewer bells and whistles, but strives to make up for it as a new challenger broker in the UK.

Easiest to use

My top two recommendations of TorFX and Wise share the crown here. Again, it totally depends on the kind of experience you want.

If self-service transfers on a mobile app are your thing, then Wise is the easiest option. Everything is smooth and intuitive - you can't go far wrong.

For some people though, using an app of any kind is not ideal.a

If this is you, then TorFX will make your life easy. Simply request a quote and they'll talk you through the whole process - providing advice but not pressure.

So there you have it!

In summary

There are three simple steps to find the best international transfer provided for your specific circumstances:

Compare foreign exchange specialists (like Wise and TorFX, for example)

Search the market for live deals

.svg)

.svg)